If you live in Maryland then you’re in luck!

Maryland tax law (Article §10-724) allows an income tax credit to be taken to offset your purchase of oyster aquaculture float(s) such as the Moonstruck Oyster Floats.

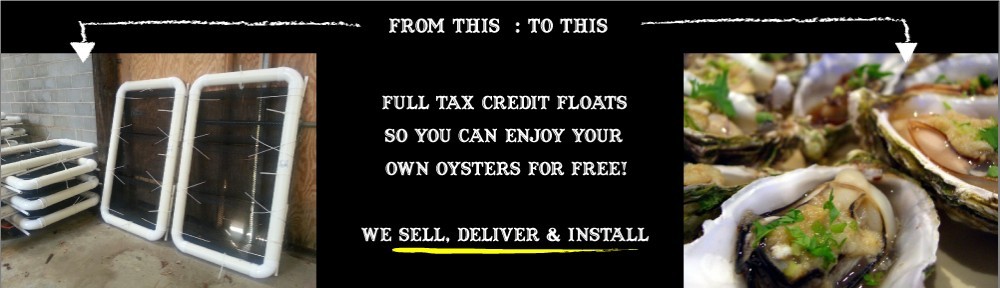

Do not be mistaken a tax credit with a tax deduction. Unlike a tax deduction (like you normally get by donating to a qualified charity organization), a tax credit is a dollar-for-dollar rebate of the money you’ve paid for the oyster aquaculture float(s).

How much tax credit are you allowed to claim under the law? Here’s a breakdown:

- Individual taxpayer – up to $500 per year

- Couples filing joint tax return – up to $1000 per year

So what does it all mean to you? Here’s an example:

Mary and John file tax jointly. For the last calendar year, they owe the State of Maryland $1500 in taxes. However, they bought two oyster aquaculture floats from Moonstruck last year for $1000 in total. But submitting the proper forms with their tax return to Maryland, they now only owe $500 to Maryland. What this means is that they essentially got the floats (and the oysters in there) for nothing. Yet, they are helping to clean the bay and have free fresh oysters available to them right on their water property.

What’s better?

They can do this year after year (see Moonstruck Continuing Service Program section below), all while being able to fully recover the purchase price of their floats with oysters, up to the $500/$1000 maximum per year.

It’s easy to claim your tax credit:

- File your Maryland income taxes using the Standard Form (Form 502)

- Attach Form 502CR (title: Tax Credits for Individuals) with your return

Below is more information about the oyster float credit from the Comptroller of Maryland website:

| Aquaculture Oyster Float Credit A credit is allowed for cost of new aquaculture oyster floats that are designed to grow oysters at or under an individual homeowner’s pier. The devices must be buoyant and assist in the growth of oysters for the width of the pier. The credit amount is limited to the lesser of the individual’s state tax liability for that year or the maximum allowable credit of $500.If the credit is more than the tax liability, the unused credit may not be carried forward to another tax year.

To claim the credit, you must complete Part D of Form 502CR and attach to your Maryland income tax return. You must also report the credit on Maryland Form 502, 505 or 515. The credit cannot be claimed on the short Form 503. |

Moonstruck Continuing Service Program

Please register with our continuing service program. There is an initial investment in float equipment at the outset, but refurbishment each year is offered with this service that we provide. When you tax return is received, reinvest the amount you received as a result of the previous year tax credit with us. When reinvestment is received, we will come to your site and install a new set of Moonstruck floats and should you choose, take away the previously installed oyster floats and any remaining oysters.